Table Of Content

It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on the back-end debt. The 28/36 Rule is a qualification requirement for conforming conventional loans. A bi-weekly mortgage is a mortgage in which the borrower makes half of their monthly mortgage payment every two weeks, rather than paying the full payment amount once every month. So if you paid monthly and your monthly mortgage payment was $1,000, then for a year you would make 12 payments of $1,000 each, for a total of $12,000.

Cash Reserve and Your Ability to Pay Your Mortgage

Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down. If your credit score is below 580, you'll need to put down 10 percent of the purchase price. If your score is 580 or higher, you could put down as little as 3.5 percent. In most areas in 2023, an FHA loan cannot exceed $472,030 for a single-family home. You’ll also need to factor in how mortgage insurance premiums — required on all FHA loans — will impact your payments.

Mortgage Interest Rate

You’ll stop paying PMI when your mortgage reaches about 78% of the home’s value. The rule of thumb is to meet with at least three lenders to compare mortgage rates but five is often preferred. The more quotes you get, the greater possibility that you can save thousands of dollars over the life of your loan.

How much is homeowners insurance and what does it cover?

Working towards achieving one or more of these will increase a household's success rate in qualifying for the purchase of a home in accordance with lenders' standards of qualifications. If these prove to be difficult, home-buyers can maybe consider less expensive homes. If not, there are various housing assistance programs at the local level, though these are geared more towards low-income households.

This means your money is going toward your actual debt and not interest on that debt. It’s important to remember that if you don’t manage to pay down the debt before the 0% APR offer ends, you might end up with a higher interest rate on your debt than you had before. That’s why it can make a significant difference if you make even small extra payments toward the principal, or start with a bigger down payment (which of course translates into a smaller loan). The bigger the down payment you can bring to the table, the smaller the loan you will have to pay interest on. In the long run, the largest portion of the price you pay for a house is typically the interest on the loan.

Mortgages

The 28/36 rule also protects borrowers as much as it protects lenders, as you’re less likely to lose your home to foreclosure by overspending on a home. Explore mortgage options to fit your purchasing scenario and save money. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. APR (%) is a number designed to help you evaluate the total cost of a mortgage.

Since 2004, she has worked with lenders, real estate agents, consultants, financial advisors, family offices, wealth managers, insurance companies, payment companies and leading personal finance websites. Amy also has extensive experience editing academic papers and articles by professional economists, including eight years as the production manager of an economics journal. Get Forbes Advisor’s ratings of the best mortgage lenders, advice on where to find the lowest mortgage or refinance rates, and other tips for buying and selling real estate.

How Much House Can I Afford on a $75K Salary? - Yahoo Finance

How Much House Can I Afford on a $75K Salary?.

Posted: Fri, 26 May 2023 07:00:00 GMT [source]

Home affordability FAQs

The ideal timeline for house hunting depends on the real estate market, what you're looking for in a home and other factors. Still, starting the search about five or six months before moving in should give most buyers enough time to get preapproved, find a home and close. After you find the right home, your real estate agent will help you submit offers and negotiate with sellers.

The most important factors that determine how much you can afford:

Let’s go over some of the inputs to our home affordability calculator, plus some extra factors you’ll want to consider. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point. While your lender is willing to loan you a substantial amount of money, that doesn’t mean you have to borrow the entire amount if it would put you under significant financial strain.

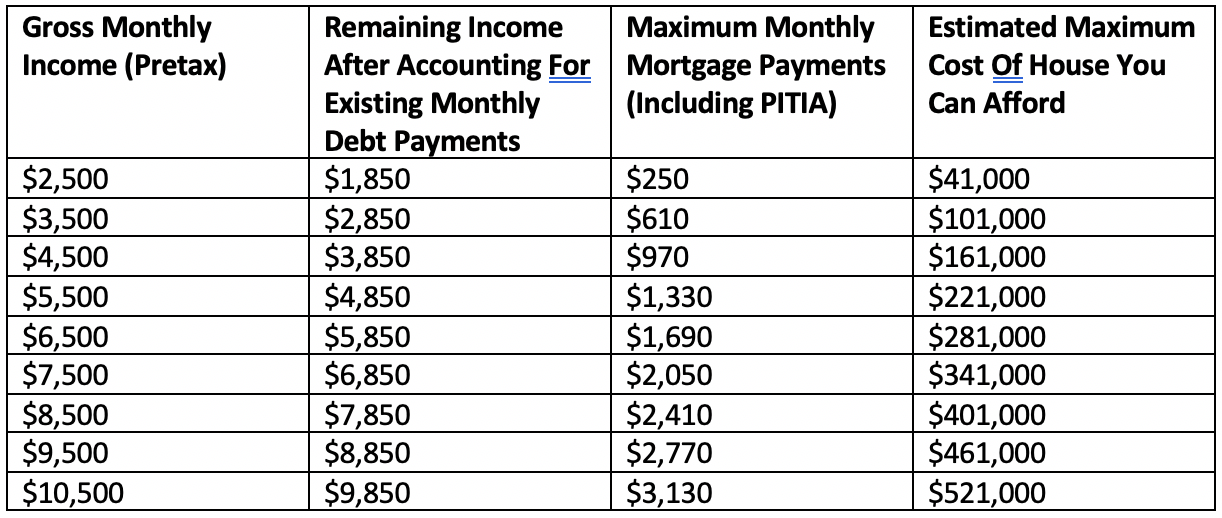

In other words, this is a measure of your total monthly debt load to see how much house you can afford on top of your other financial obligations. Someone who gets a lower mortgage rate can afford a more costly home. Compared with a less qualified borrower, you’re either making a lower monthly payment for the same sized mortgage or the same sized monthly payment for a bigger mortgage. You might think your savings alone determine how much house you can afford.

Just enter your location, yearly income, monthly debts and how much money you have for a down payment and closing costs. The calculator will take this information and tell you how big of a loan you can safely take on. The annual percentage rate (APR) is a number designed to help you evaluate the total cost of a loan. In addition to the interest rate, it takes into account the fees, rebates, and other costs you may encounter over the life of the loan. The APR is calculated according to federal requirements, and is required by law to be included in all mortgage loan estimates. This allows you to better compare different types of mortgages from different lenders, to see which is the right one for you.

Remember that there are other major financial goals to consider, too, and you want to live within your means. Just because a lender offers you a preapproval for a large amount of money, that doesn’t mean you should spend that much for your home. A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full.

No comments:

Post a Comment